AIQ Markets

Bond Copilot.

We partnered with AIQ Markets to build a copilot that makes fixed-income markets accessible. Bond discovery, portfolio construction, optimisation, rebalancing, and ladder building in one intelligent interface.

Ashfia Tough

December 2025

The challenge

Fixed-income markets are opaque. Finding the right bonds, comparing yields, and building diversified ladders requires specialist knowledge and expensive terminals.

AIQ Markets wanted a copilot that lets investors describe what they need in plain language and get back actionable recommendations, portfolio structures, and ladder strategies. Not a chatbot. A genuine decision support tool for fixed-income markets.

What we built

Bond Discovery

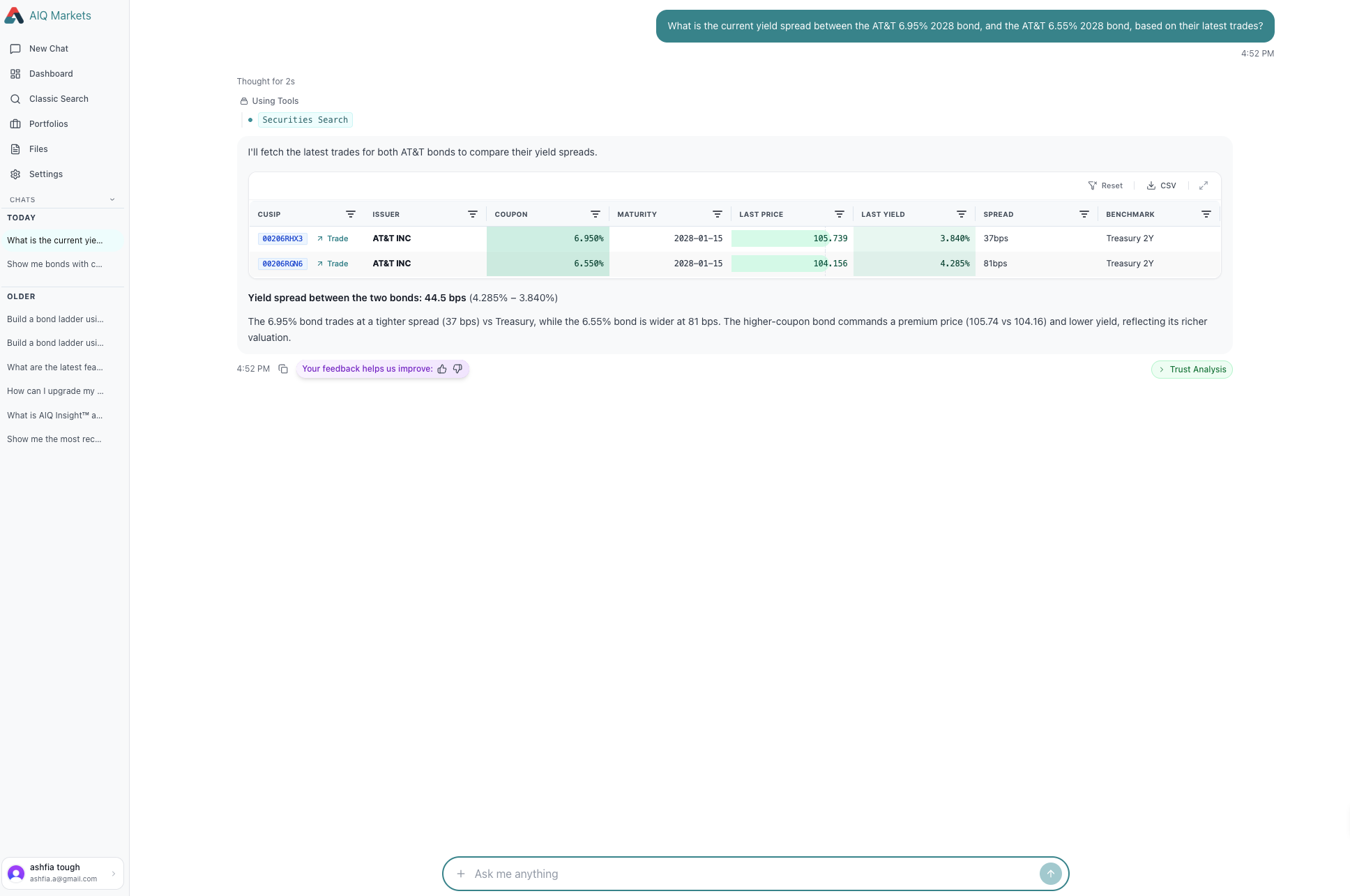

Natural language search across live market data. Investors describe their criteria (yield targets, maturity windows, credit ratings) and get filtered, ranked recommendations. No more scrolling thousands of CUSIPs.

Portfolio Construction & Optimisation

AI-assisted portfolio building, optimisation, and rebalancing. The copilot considers diversification, duration risk, credit exposure, and yield targets, then suggests allocations, flags concentration risks, and rebalances portfolios as market conditions change.

Ladder Builder

Automated ladder construction across maturity dates, optimised for yield and reinvestment timing. Investors specify their horizon and cash flow needs, and the copilot builds a balanced ladder in seconds.

Scaling the Product

Beyond the initial build, we partnered on product strategy, infrastructure scaling, and ongoing feature development. We evolved from builders to embedded technical partners as the user base grew.

Our role

Embedded technical partners, not a vendor hand-off.

Product Development

Concept through production, shaping capabilities and user experience alongside the AIQ Markets team.

AI Engineering

Natural language processing, recommendation engine, and portfolio optimisation layers built on our agentic AI framework.

Domain Expertise

Decades in TradFi, bonds, and financial services. We understood the domain, not just the technology.

Scale & Reliability

Architected for production workloads with financial-grade performance and compliance standards.

Results

Bond Discovery

Natural language search replaces manual filtering across thousands of instruments. Minutes, not hours.

Portfolio Intelligence

AI-driven portfolio construction, optimisation, and rebalancing with risk scoring and diversification analysis built in.

Automated Ladders

Ladder strategies generated in seconds, optimised for yield and cash flow requirements.

Production Ready

From concept to live product with real users. Built to scale with financial-grade reliability.

Why it worked

We embedded with the AIQ Markets team as technical partners, bringing both AI engineering and capital markets knowledge. The result is a product that understands bonds the way a trader does.

We can read a balance sheet, price a bond, and sit in a commercial conversation from day one. Most AI consultancies need months of domain education. We skip that and get straight to shipping.

That means we're not just building tech, we're part of the commercial story. Revenue models, customer value, and market positioning alongside the architecture.

Building AI for

financial services?

We bring AI engineering and domain expertise. No ramp-up time, no explaining what a bond ladder is.